The one of a kind financial asset has been compared to gold and said to have the potential to unseat the dollar as the global reserve currency one day. But how does Bitcoin go from the first example of peer to peer digital cash system to a store of value, to taking over the world? And what does that mean for the cryptocurrency as an investment? This guide will supply all the pros and cons related to Bitcoin investing and explain how to invest in Bitcoin and the different ways to do so for the most profit.

Bitcoin Investing: What Is It?

Although there has never been anything like it before and differs vastly from stocks, bonds, forex, and more, Bitcoin is an asset – but a digital asset.

Unlike gold that exists physically or shares of a company, Bitcoin acts as a sort of a digital commodity or collectible that also works as a currency.

But because this new asset was launched publicly yet in the shadows, its price began at under a fraction of a penny. The first recorded Bitcoin price traded was at $0.003. Today each BTC sells for over $50,000 and expectations are that is goes much higher than that.

Almost anyone who has ever bought Bitcoin has been profitable, aside from those who bought recently. ROI for those who bought in around the early days is over 100,000,000%.

Price rises by over 5,000% between each bull market peak. A surge of similar magnitude would take Bitcoin to $500,000 per BTC in the future. These seemingly unrealistic targets line up with expert price predictions from the likes of billionaire investor Tim Draper or Max Keiser.

Is Bitcoin a Good Investment? A Look Back At 2020 Performance

With such substantial ROI in the past, investors often wonder if Bitcoin is a good investment still in the long term or if the best gains are in the past.

2020 was the year of Bitcoin, however, as it emerged as the stimulus asset and has grown substantially in the face of unprecedented money printing. As more fiat currencies are printed, such as USD, in response to stimulus efforts to combat the pandemic, there only will ever be 21 million BTC. Those who fear inflation and those with cash reserves that are losing value, have begun to move money into Bitcoin instead, causing an uptrend to start.

Investing in Bitcoin in 2021: Is It a Good Idea?

As ROI of 100,000,000% over the last decade shows, investing in Bitcoin is always a good idea. Timing when to buy and sell is the tricky part of maximizing returns and profit from the cryptocurrency market’s high volatility.

Year to date in 2021, Bitcoin investing is up over 200% and could be on its way toward another 1,000% climb. Here are several fundamental, technical, and more reasons for a new Bitcoin bull run forming and why it is as great of an investment as ever – if not the best time to invest in Bitcoin.

Bitcoin Fundamental Analysis

Cryptocurrencies are built on blockchain networks and have unique attributes like digital scarcity and are powered by miners. These unique and unfamiliar terms to traditional finance make fundamental analysis vastly different in Bitcoin.

Most fundamental analysis looks at blockchain metrics, such as how much BTC is kept on crypto exchanges and cryptocurrency trading platforms. This metric dropped to the lowest level since the last bull run, suggesting that no one wants to sell their Bitcoin. When no one is selling, demand rises, and so do prices.

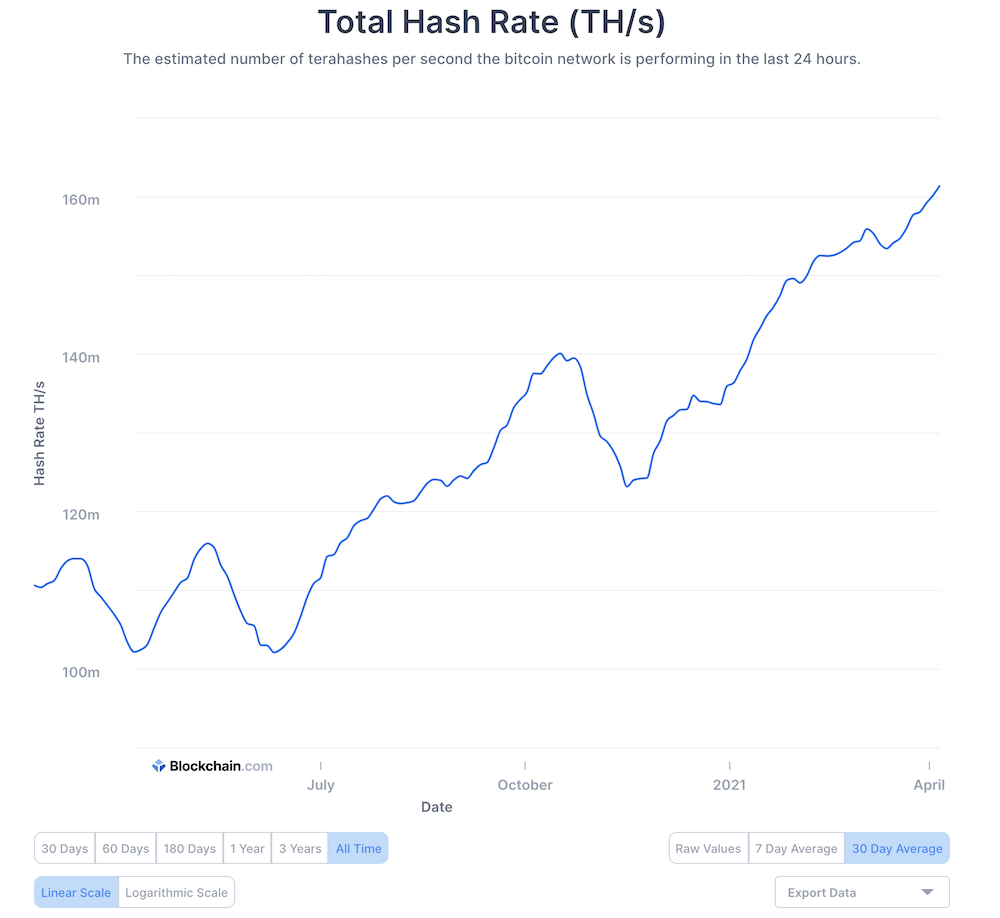

Total BTC held by smaller wallets is increasing while whale wallets decrease, showing greater distribution and decentralization. Network hash rate regularly sets new all-time highs.

Bitcoin Technical Analysis

Technical analysis looks just as good for Bitcoin, with the asset breaking up out of a multi-year bear market with a rounded bottoming pattern.

The last time the cryptocurrency broke up out of this pattern, a 1,500% rally took place. Several high timeframe Bitcoin trading indicators also confirm bullish momentum is ready to take Bitcoin even higher than $50,000 per coin currently.

Learn more about Technical Analysis

Bitcoin Sentiment Analysis

The sentiment surrounding Bitcoin has never been higher. Google Search for “buy crypto” has been searching and so has searched for Bitcoin. Not since the crypto bubble was the term searched for this often.

The leading cryptocurrency by market cap has also enjoyed a resurgence in interest surrounding its use as a safe haven asset and hedge against inflation. During the COVID pandemic, the US Federal Reserve and central banks have been printing trillions of dollars in money supply, causing the dollar to weaken and inflation to soar.

As hedge funds, institutions, and even corporate treasuries have scrambled to protect cash reserves, many have begun looking toward Bitcoin as a hedge against inflation. Billionaire hedge fund manager Paul Tudor Jones thinks that Bitcoin will be the fastest racehorse in the race against inflation, comparing it to gold in the 70s.

At that time, gold cost just $30 an ounce, and today costs nearly $1,600 for the same ounce of gold. Bitcoin is called digital gold due to its hardcoded digital scarcity built into the network’s core. Only 21 million BTC will ever exist.

If every major hedge fund, firm, or institution tried to buy that much Bitcoin suddenly, there wouldn’t be enough to go around, and it would send prices skyrocketing from supply and demand.

Expert Expectations and Bitcoin Price Predictions

Billionaire investor Tim Draper, an early angel investor in Facebook and nearly every other major investment success story, believes that Bitcoin will reach $250,000 by 2023, and thinks that could be a modest target.

“$250,000 means that Bitcoin would then have about a 5% market share of the currency world, and I think that maybe understating the power of Bitcoin,” Draper said.

Max Keiser, the host of the Keiser Report, believes that Bitcoin will reach $400,000 over the next several years. Keiser first called for the cryptocurrency to reach $100,000 back when it was trading at just $1 per BTC.

“I am officially raising my target for Bitcoin — and I first made this prediction when it was $1, I said this could go to $100,000 — I’m raising my official target for the first time in eight years, I’m raising it to $400,000,” Keiser said. Learn more about Bitcoin price predictions

Ways To Invest In Bitcoin

Investing in Bitcoin early on was almost impossible. You had to either mine it or get it as a gift. Today, it’s as simple as a few clicks to invest in Bitcoins or buy Bitcoin online. Once you have Bitcoin, you can decide between the various ways to invest in crypto. Here are some of the most common Bitcoin investment strategies.

Buy and Hold

Buying and holding a cryptocurrency like Bitcoin involves first purchasing the asset on a spot exchange or other cryptocurrency trading platform and storing it in a wallet, either on the exchange or in cold storage for the long-term.

This involves the least amount of thought but does involve risk. For example, in 2019, Bitcoin rose from under $4,000 to $14,000. In 2020, it fell back to under $4,000. Those who bought and held would have missed out on an enormous amount of profit. Today it is well over $60,000.

Trading

Rather than buying and holding an asset, inventors can also trade their Bitcoin at each high or low. There are two main methods of doing this: spot or derivatives trading.

Spot trading involves buying and selling an underlying asset high or low, trying to profit based on the price changes in between. More profit is possible, but when markets are crashing, the only option is staying in cash while asset prices fall. There’s no way to actually profit during downtrends.

Traders who bought Bitcoin at under $4,000 and sold at $14,000 would have $10,000 in profit, and when Bitcoin fell back below $4,000 could have bought the Bitcoin back and still had $10,000 to spare.

Derivatives trading opens up the door to profit no matter which direction the market turns. Derivative contracts like CFDs allow long and short positions, so traders can profit whichever way the trend goes next. This also allows additional tools to be added, such as leverage and more.

In the derivatives example, not only could traders have profited as Bitcoin rose from $4,000 to $14,000, shorting Bitcoin at $14,000 back down to $4,000 would have doubled the profit. Add in something like 100x leverage, and the $20,000 in profits could be as much as $2 million – that’s the power of derivatives trading and CFDs offered by Noble Pro Trades. Learn more

Pros and Cons of Bitcoin

Bitcoin is clearly a smart investment; however, there are several pros and cons any crypto investor should pay attention to when considering investing in Bitcoin.

Pros

- Bitcoin has the most significant ROI out of any financial asset every.

- Bitcoin has outperformed gold, stocks, oil, etc. in 2021 year to date.

- Bitcoin was the first-ever cryptocurrency.

- Bitcoin can act as a hedge against inflation.

- Bitcoin is digitally scarce, making it rare and valuable.

Cons

- Bitcoin could go to zero.

- Bitcoin is extremely volatile, so price swings can be violent due to the low overall liquidity compared to other asset classes.

- Bitcoin could face stiff regulation in the years ahead.

- It could be years until Bitcoin’s full value is ever realized.

How Much To Invest In Bitcoin?

How much to invest in Bitcoin is ultimately up to you and your comfort level. The most common advice people receive when first starting to invest in Bitcoin is never to invest more than you can comfortably afford to lose.

The advice is wise, as although Bitcoin could reach $500,000, it could also go to zero in the future. With such new and disruptive technology, it either comes through as a new form of finance or fails entirely as an experiment.

It may be worth getting started small with just tiny BTC increments before jumping in with a more considerable investment. Bitcoin can be purchased in any denomination, with the smallest possible amount being 0.00000001 BTC.

Is Day Trading Crypto Profitable?

Day trading crypto can be extremely profitable. For example, those who traded Bitcoin at the 2018 bottom to the 2019 top, then back to the 2020 bottom, would have made a large sum of money. Those who take advantage of CFDs, long and short positions, and leverage turned those profits into even larger margins.

Why Choose Crypto Over Traditional Investments?

Crypto assets are highly volatile, making them an ideal asset for trading. Enormous profits have been generated from trading these assets and the price swings in between.

Is It Worth It To Invest In Bitcoin?

Considering the asset's 100,000,000% ROI and the fact it beats out all other assets, including stocks, gold, and oil in year to date returns, yes, Bitcoin is definitely worth considering. Just remember never to invest more than you can afford to lose and only buy Bitcoin from a safe, reliable trading platform.

Is It Smart To Invest In Bitcoin?

Investing in Bitcoin has always proven smart, and will continue to do so as long as the financial technology remains valid, and the network remains secure and churning away. Bitcoin is also an extremely smart investment for those that are looking to hedge against inflation in the dollar and other fiat currencies thanks to central banks' mismanagement of monetary policy.

Is Bitcoin a Good Investment?

Bitcoin is a good investment for those willing to take the chance on an emerging financial technology with the potential to change the world. The scarce digital asset could one day replace the dollar as the global reserve currency.

What Is The Minimum Amount To Invest In Bitcoin?

The minimum to get started trading Bitcoin on Noble Pro Trades is just 0.001 BTC. Investing starts at similar minimums but involves holding the asset for the long term. Trading has proven more profitable for Bitcoin.

Should I Invest Now In Bitcoin?

There is never a time that's too late to buy Bitcoin and start investing in cryptocurrencies. You can do it now, or dollar cost average into the investment over time. Either method can move into trading over time.

Where To Invest In Bitcoin?

The best place to invest in Bitcoin is Noble Pro Trades. The award-winning Bitcoin margin trading platform offers CFDs on crypto, commodities, stock indices, and forex all under one roof, complete with leverage and long and short positions so traders can maximize profit no matter which way the price moves. Noble Pro Trades offers both the ability to buy Bitcoin for investing or move it to a trading account for even more profits. Trading accounts are completely free and take just a few clicks to get started. Minimum deposits start at only 0.001 BTC. Noble Pro Trades also offers all the trading tools required for success, including built-in technical analysis software and a peer to peer copy trading platform called Covesting, where traders connect to profit together.

Risk Disclaimer:

Investing in or trading gold or other metals can be risky and lead to a complete loss of capital. This guide should not be considered investment advice, and investing in gold CFDs is done at your own risk.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities, and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of Noble Pro Trades. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. Noble Pro Trades recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.